What are “emerging technologies”, and can they help me? Answer: Depends on your age, and yes they can! Let’s face it, a lot of technological changes have occurred in the past 50 years of my working lifetime. Consequently, your perspective on “emerging technologies” depends on your age. It’s easy today to look at buildings (for example) that were built 50 years ago and mutter the words “What were they thinking?“, because of what you know to be true today. However, a great deal of that “change” has come from both real time emerging technology and higher costs for energy products (electricity & fuels). The miracle of the Free Market: the ebb and flow of supply and demand can produce amazing results. Sometimes progressive thinkers invent things before we can dream them up, and once invented, we want them immediately. Sometimes WE are the ones who clamor for answers and inventors respond with the solutions. When it comes to producing energy and using energy, for the most part, change has evolved over the past fifty years more slowly than in other industries due to the “disruptive” nature of the commodity market changes …..as well as the governmental shift from monopolized markets to regulated markets to unregulated markets. We are all still waiting for the free, perpetual energy machine to reach the market! And yes, from time to time we see “government” stepping in with programs or incentives to push us in a particular direction…………. or regulate us in such a way to accomplish the same thing.

On the energy supply side, we have seen dramatic swings in the pricing, origins (location), and extraction methods for crude oil. Natural gas, once almost an afterthought, is now a global commodity with the expectation of large volumes of liquefied natural gas (LNG) to be exported around the globe from the US….. due to recently developed fracking extraction technology. Massive sized wind turbine farms dot the landscape all over the globe, as do its sister renewable energy technology, solar PV farms. Behind the meter PV systems are growing like wildfire on residential, commercial, and industrial rooftops all around the world. Nuclear energy, once the expected salvation for “cheap” electrical energy in the 1960’s, became politically impossible to site after numerous concerns for safety and health in the US….. but due to recent R&D capital infusions by wealthy entrepreneurs, may make a comeback in the future if it can compete financially. Also away from the heavy environmental regulations of the US, hydropower energy has continued to expand to provide fossil fuel free electricity to millions of people around the globe, many of whom never had any electricity before. Coal, once a staple of both fuel and electricity production, is now a dirty word in the American culture, and devoid of a cost effective “clean technology” scrub, may be discontinued completely in another 25 years in the US ………with coal exports headed outside the US to more emerging economies. Once only known for building materials and firewood, trees have turned into Biomass (wood chips) used for both generating electricity and running boilers for heat and process steam……. not to mention processed wood pellets for stoves and boilers. Geothermal energy, used mostly in relatively smaller scale applications so far, has enormous potential for larger use. Fuel cells, creating both electrical and thermal energy are in use already and will continue to expand as the technology and pricing continue to change. Throw in new battery storage technology for storing excess energy (mainly from full run renewable generators like wind and PV), and the energy world continues to evolve. All of this has happened in the last 50 years with the cycle of “change” getting faster.

On the consumption side, we have witnessed a continuous education of the users of energy over the past 50 years to “conserve” or use less of all of these energy commodities. Cars, trucks, buses, homes, factories, office buildings, etc ………all using less fuel and/or electricity today. Some of this change is driven by “government”, but a great deal is also driven by a combination of economics and societal change. It is no longer acceptable to “waste” energy if the same task or product can be done more efficiently. Entrepreneurs and product developers understand these dynamics, and the pace of “efficiency” changes has increased dramatically over the past 20 years. Talk to a typical millennial and you will find they know no other mantra ………and they are just now entering into the front end of their highest earnings/spending years. Government has assisted along side that trend line as well. Industry is beginning to see a price flattening of the energy supply side of fuels and electricity on a regional basis, and there are significant regional differences based upon the costs of production of these commodities on a regional basis. The further away from the source, the higher the “transportation” costs are going to be ……….in addition to any government taxes, fees, or policy costs that are regionally or locally applied. Clearly, the costs for the transmission and distribution of electricity in the ISO-NE territory are on the rise in a largely monopolized industry……. and those costs will increase even more if outside security threats force greater “hardening” of our electrical grid system ………. leading to even more, smaller distributed energy resources (DER) to reduce the risks. Hint: You will be reading more about “microgrids” as time goes forward. What is the risk to your company if the grid you are connected to goes down for any length of time?

If, as a business, you exhaust your ability through competition to lower the commodity pricing of your energy, you are left with five basic options:

- Move/expand your operations to a lower cost region of the country or the world

- Take actions to use less energy and/or less “peak” priced energy where you already are located

- Do nothing, and pass the costs on to your buyers (if you can)

- Do nothing, and pass the costs on to your shareholders (if you dare)

- Become a direct participant (purchaser) of electricity in ISO-NE

We have certainly witnessed these options, or combinations of these options, play out in New Hampshire and expect to see more of that in the future. That assumes (see Blog Post #12) that government continues to fail to provide any creative solutions on the industrial electrical rate relief front.

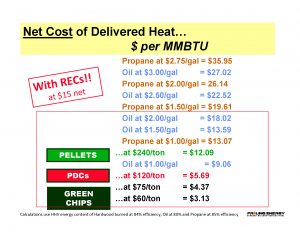

Aside from than moving away to another region, becoming an ISO-NE participant, or doing nothing, the last option is to cut commodity use. Most of those (cutting consumption) options require the use of your own capital, and installing new technology. Be sure that you have exhausted your ability to cut supply costs through competition, even if that also requires bringing in a third party buyer like a Freedom Energy Logistics type company (Blog Post #10) to accomplish it …. or going directly to ISO-NE as a direct purchaser. We have already talked about undertaking an internal energy plan (Blog post #8): and incorporating energy efficiency (Blog post #9): and using alternative fuels like Biomass (Blog post #13) from Froling Energy. The most unpopular thing I have to tell any industrial operation is, quite frankly, the need to get past the normal criteria for internal paybacks of 18-24 months for use of your own capital when doing some energy improvements………understanding that its a tough sell for Wall Street.

Private Equity held companies have more flexibility to take (investment) actions that are “out of the box”, as do closely held and/or family held enterprises. Whatever capital intensive changes you do make, they are likely to give you financial benefits for the next 20-25 years, or sometimes longer. That is a decision only you can make. If I had any magic energy bullets to give you ………I probably wouldn’t be writing this blog for you today because I would be way too busy spending my $$millions or playing golf or both! Cheers………. HT!